Example

Understanding the Different Types of Insurance Policies

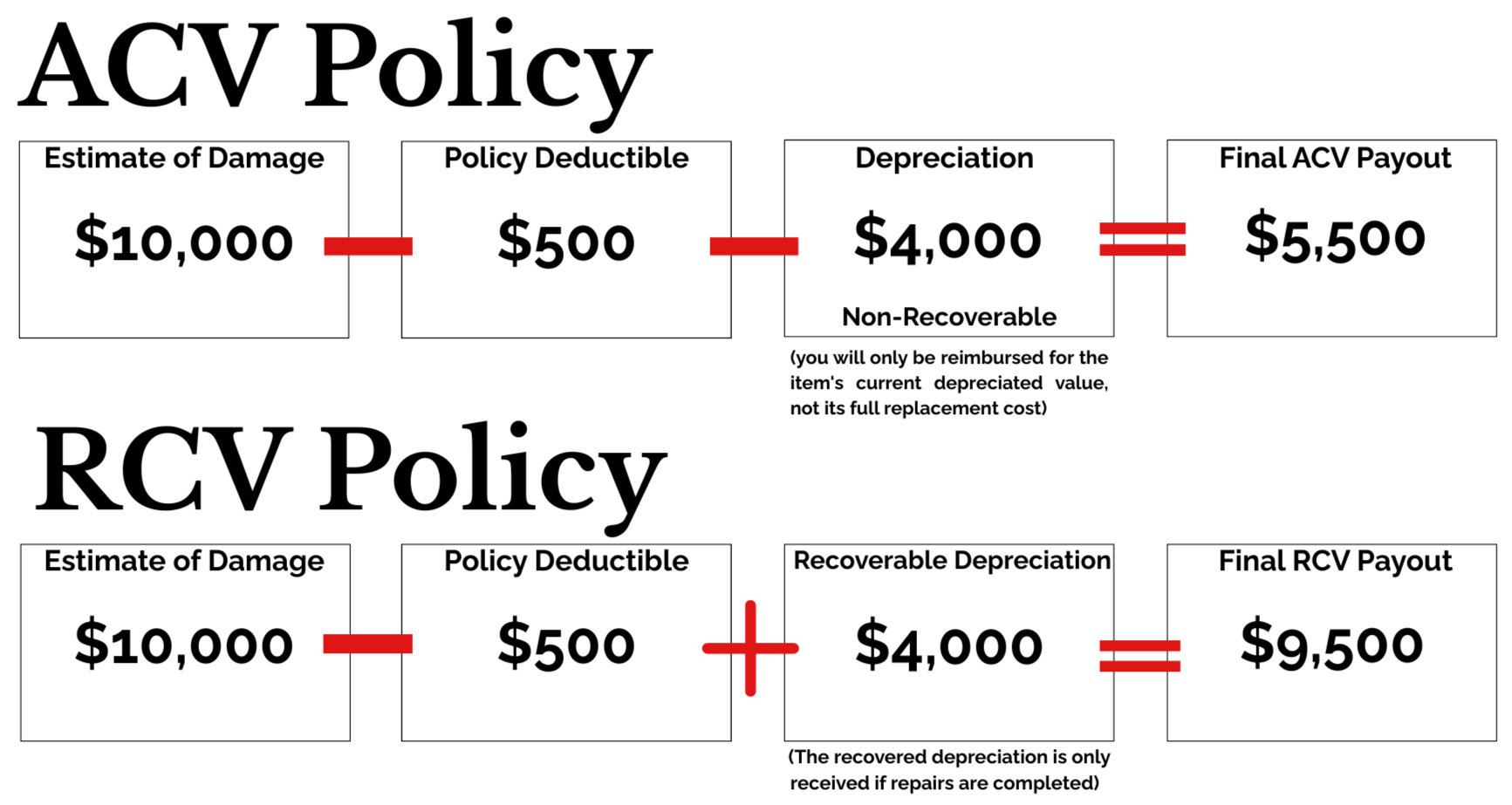

ACV Policy

Definition: The amount you receive after a claim is paid is based on the current market value of the item, considering depreciation due to age, wear and tear, and obsolescence

RCV Policy

Definition: The insurance company pays you the full cost of replacing the item with a new one of similar kind and quality, without deducting for depreciation if repairs are completed.

Depreciation: a reduction in the value of an asset with the passage of time, due in particular to wear and tears.

Non-recoverable: Non-recoverable depreciation refers to the portion of an item's value lost due to wear and tear, age, or other factors, that is not reimbursed by insurance when a loss occurs. This means that if you have an ACV (Actual Cash Value) policy, you will only be reimbursed for the item's current depreciated value, not its full replacement cost.

Recoverable: recoverable depreciation is the difference between a property's replacement cost value (RCV) and its actual cash value (ACV) in an insurance claim. It's essentially the portion of the claim payout withheld by the insurance company until the insured proves they have repaired or replaced the damaged item. (To recover this depreciation, you typically need to provide proof of replacement or repair, such as receipts or invoices)

Disclaimer: The information provided above about ACV (Actual Cash Value) and RCV (Replacement Cost Value) policies is for general educational purposes only. Coverage terms, depreciation rules, and claim outcomes vary by insurance company and individual policy. PrairieLand Construction LLC does not determine insurance coverage, payouts, or eligibility. For guidance specific to your policy, please contact your insurance provider or licensed adjuster